|

Our Tech

|

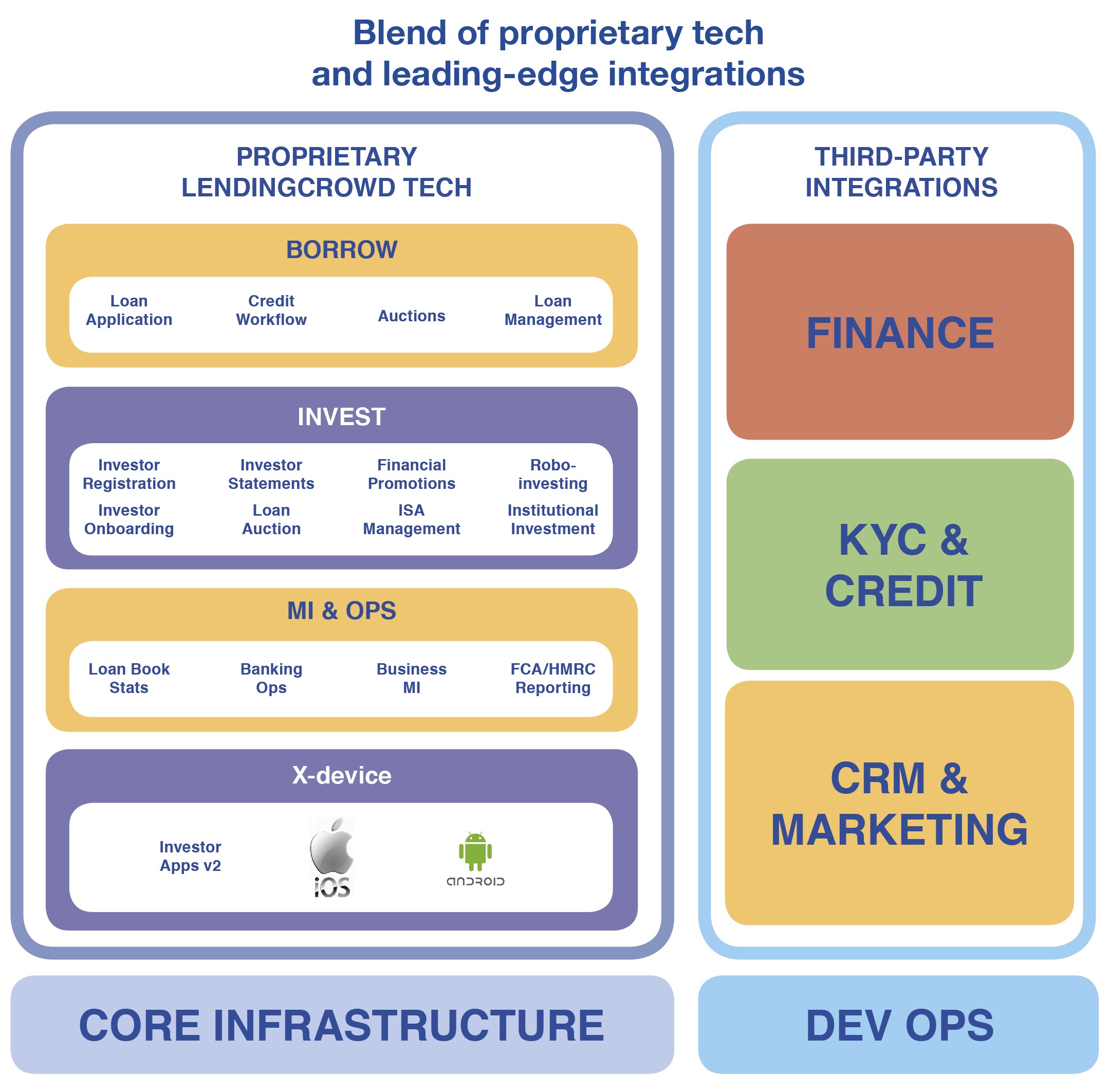

With an in-house team of tech experts, backed by best-of-breed solutions from third-party providers, we have created the perfect blend of proprietary technology and leading-edge integrations.

From the very outset, we have worked to create a tech-enabled business with strong financial service fundamentals. Credit risk analysis, robust lending decisioning and “know your customer” identity verification processes form the core of our proposition. This focus on compliance ensured that LendingCrowd was the first SME-focused fintech lending platform to move from interim to full FCA permission in November 2016.

Lending to date

Retail investor funds to date

Financial transactions processed

First major institutional debt raise

Tech investment in a robust, leading edge tech platform

Number of loans

Our expertise in technology and finance allowed LendingCrowd to become an ISA manager and launch one of the first Innovative Finance ISAs on the market. By harnessing the power of the cloud and using agile, test-driven development, we can innovate rapidly, launching new products to meet market demands.

LendingCrowd’s platform, built on our tech expertise, takes investors’ funds and deploys them across primary and secondary lending marketplaces. Sophisticated investors can select their own portfolio of loans, while those who prefer a hands-off approach can let the platform automatically create their own portfolio and reinvest returns on their behalf. The platform processes and stores over 27 million financial transactions and facilitates 28 million scheduled repayments to investors.

EAF’s technology stack gives LendingCrowd the flexibility and agility to scale at speed.